How to pay your IRS quarterly estimated tax payments:

To pay your personal estimated tax payments you can mail a check to the IRS or you can pay the it electronically by following the procedure below:

1. Click here to access the IRS website.

2. Select either Pay from your Bank Account or Pay by Debit Card, Credit Card or Digital Wallet. NOTE: They add a fee if you pay via credit card.

3. Select Make a Payment button.

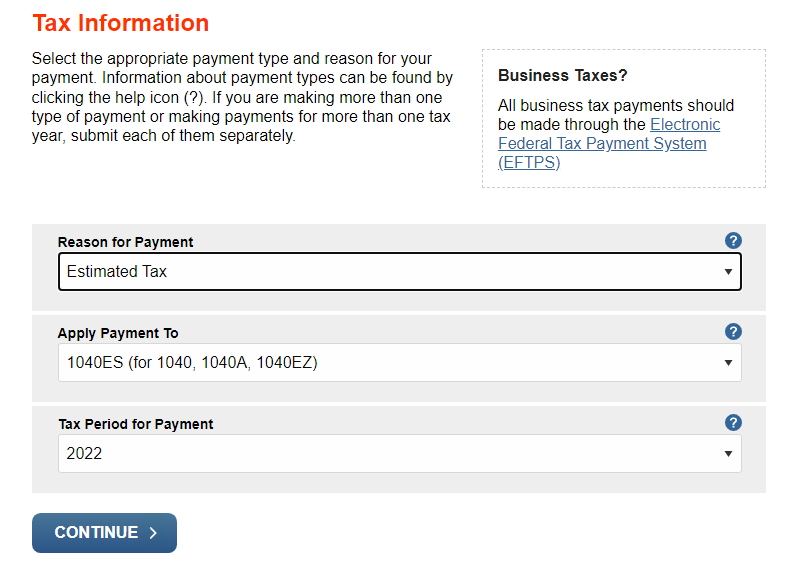

4. Select the options shown below:

5. The next screen will ask you to verify all your personal information listed on your prior year tax return. If you don’t know what that information is you look it up on our portal. We generally have the prior year tax return (1040) on our portal for you to access.

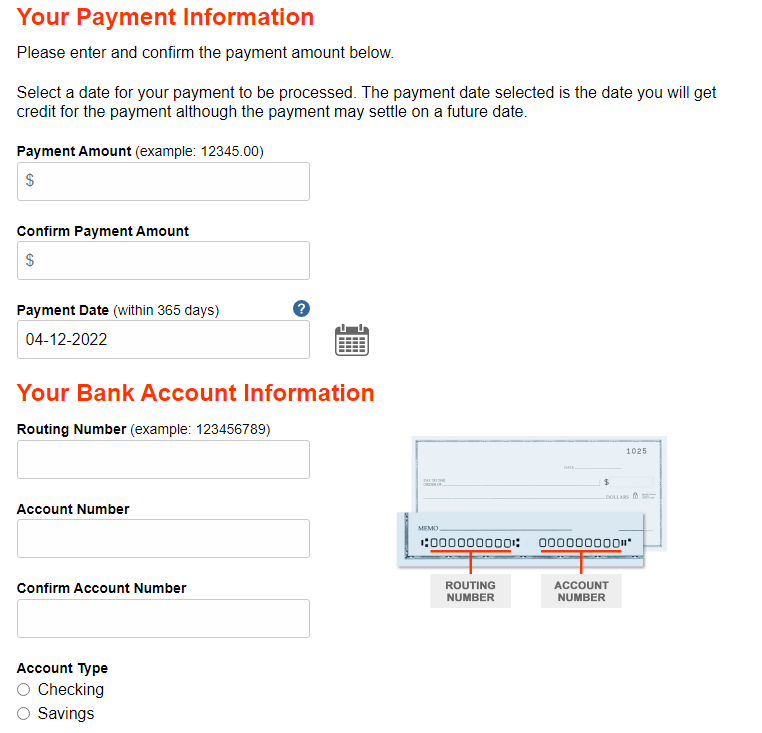

6. Next, enter your payment information. After you are done with this step the IRS will send you an email verification. Keep in mind you will need to keep that confirmation for future reference.